Senior Employees who are not yet eligible to enjoy pensions are construed as those who have not satisfied the condition on the time of social insurance contribution as prescribed by law[1]. Therefore, Employers are still obliged to pay the premiums of the following compulsory insurance for Employees:

- For SI contribution[2], Employees who work under LCs of at least full 01 month are the subjects who must participate in compulsory SI;

- For HI contribution[3], Employees who work under LCs of at least full 03 month are the subjects who must participate in compulsory HI;

- For UI contribution[4], Employees who work under LCs of at least full 03 month are the subjects who must participate in UI.

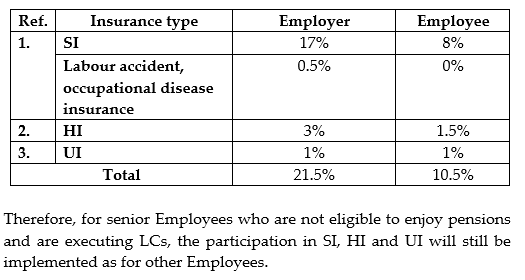

The percentages of insurance premiums paid by Employers and Employees are as follows[5]:

[1]Article 187.1 Labor Code

[2]Articles 2.1.a and 2.1.b Law on SI

[3]Article 12.1.1 Law on HI

[4]Article 43.1 Law on employment

[5]Decision 595/QĐ-BHXH dated 14/04/2017