1.How are the welfare policies regulated?

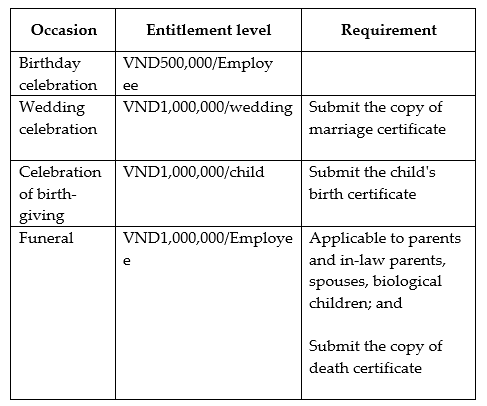

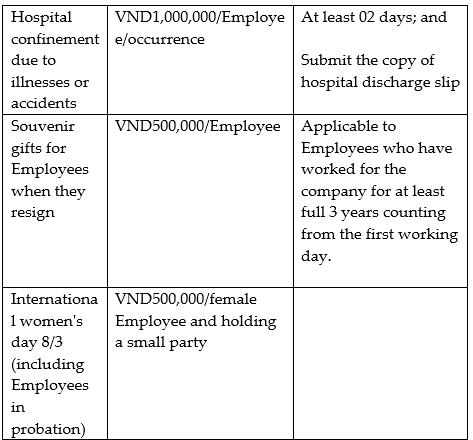

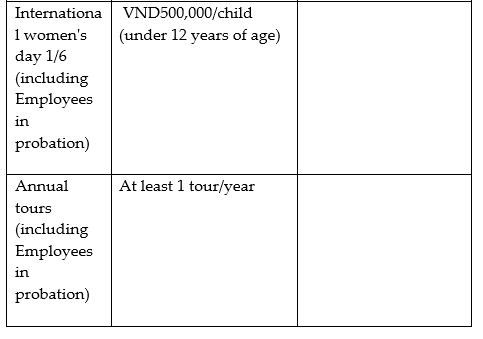

Normally, the enterprise’s welfare policies are included in the CLA. For convenience in establishing these policies, Employers may refer to the contents in the following table which can be revised to meet the specific policies of each company and comply with law:

| Note: Employees who have worked for the company for at least a full 1-year counting from the first working day will be entitled to 100% benefits. Applicable to all other regimes and events (if any). Employees who have worked for the company for at least full 1-year counting from the first working day will be entitled to 50% benefits. The entitlement level is applicable to all other regimes and events (if any). |

2. Is it possible to include the enterprise’s welfare policies in the Employee’s handbook?

Historically, the Employee’s handbook originated from foreign companies in Vietnam. The Employee’s handbook often includes all the information that the company wishes to communicate to its Employees:

– History, vision, mission and core values of the company;

– All the regimes and policies being applicable in the company which include working hours, recruitment, training, leave days, confidentiality undertakings, awards, disciplinary actions etc.

– General code of conduct;

– Welfare regimes for Employees; and

– Other rights and obligations of the parties etc.

This shows that the Employee’s handbook includes the information partly collected from the ILRs and the CLA of the enterprise. However, the ILRs and the CLA are the two documents which competent state agencies see as having legal validity, but the Employee’s handbook does not have the legal validity. Specifically, if a labour dispute arises, it will be settled based on the ILRs and the CLA. For the cases where labour disciplines need to be applied or labour disputes need to be settled, the ILRs will be used to handle these cases; or if the Employee’s handbook provides for the regimes better than those in the CLA, the regulations in the CLA will be prioritised in case of labour disputes.

Moreover, only the regimes prescribed in the CLA are recognised as the deductible expenses of an enterprise in calculating CIT (if eligible), and the regulations in the Employee’s handbook will not be recognised as reasonable costs to be deducted from CIT.

For the reasons above, the Employee’s handbook is just a document which an enterprise should have but is not required to have from the legal perspective as opposed to the ILRs and the CLA. Therefore, Employers should consider including the welfare policies into the CLA or both the CLA and the Employee’s handbook instead of only the handbook to ensure their legal compliance and effectiveness.