1.The natural disaster prevention and control fund

This is a fund at the provincial level and managed by the provincial people’s committees. The Fund is not financed by the State budget and does not originate from the State budget. The Fund’s financial sources will be compulsorily contributed by domestic and foreign economic organisations in the locality, Vietnamese citizens of full 18 years of age to the maximum employment age as prescribed by law and other lawful sources[1]. Accordingly, financially independent economic organisations and individuals are obliged to contribute to the Fund[2].

2. Rates of contribution to the Fund

2.1. For financially independent economic organisations:

The compulsory rate of contribution is 2/10,000 of the total value of assets in Vietnam based on the annual financial statements, but 500,000 dong as a minimum and 100,000,000 dong as a maximum, and this contribution can be booked into the expenses of production and business[3].

2.2. For Employees in enterprises:

The Employee’s rate of contribution is 01 day’s salary/person/year based on the regional minimum salary[4]. Regarding this contribution, if there is no other agreement between the parties, Employers need to notify Employees that they will appropriate part of Employees’ salaries to contribute to the Fund. In particular, the daily wage for 01 working day will be determined by dividing the monthly salary by the normal number of working days that is chosen by the enterprise as prescribed by law, but 26 days as a maximum[5].

Therefore, Employers need to refer to the actual number of working days in the month when Employees’ salaries are expected to be appropriated (total days of the calendar month – weekly days off as prescribed in the LC or the registered ILRs) to determine the Employee’s rate of contribution to the Fund and then implement the appropriation accordingly.

3. The cases where the contribution to the Fund may be exempted, reduced or delayed[6]

3.1. The subjects which are not required to make contributions include:

- War invalids and those who are entitled to the policies for war invalids;

- Biological parents, spouses of martyrs;

- Military personnel serving in military forces, non-commissioned officers, public security forces with definite service durations who are enjoying living allowances;

- Students and pupils who are following full-time and long-term education programs in Universities, Colleges, High-Schools, Vocational Schools;

- People with disabilities or a decrease in working capacity of 21% or more; people with critical illnesses and certified by a hospital of district level or above;

- People who are in the period of unemployment or unemployed for 06 months or more in a year;

- Members of households in the category of poverty or near-poverty; members of households in high, rural and remote areas; members of households which are damaged by natural disasters, epidemics, fires, explosions, or accidents;

- Cooperatives which do not have incomes; and

- Financially independent economic organisations which have their assets, factories or equipment damaged by natural disasters in the year; which must make repairs or purchases with a value of over 2/10,000 the total value of assets, or stop business, production activities for 5 days or more.

3.2. The subjects which are entitled to contribution reductions or delays include:

Financially

independent economic organisations which are entitled to CIT exemption or

reduction will be considered to enjoy contribution reductions or delays.

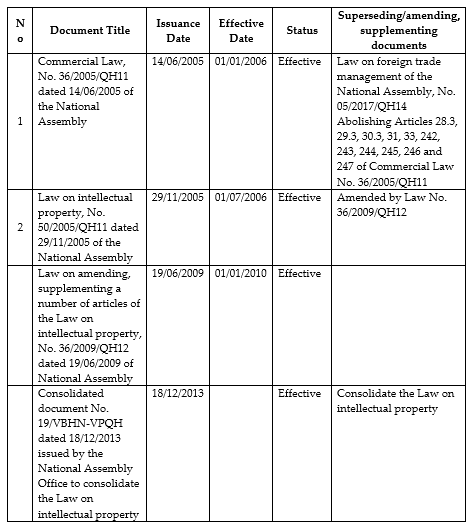

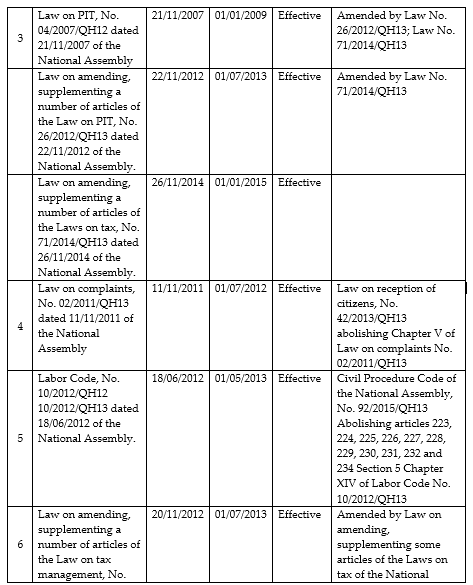

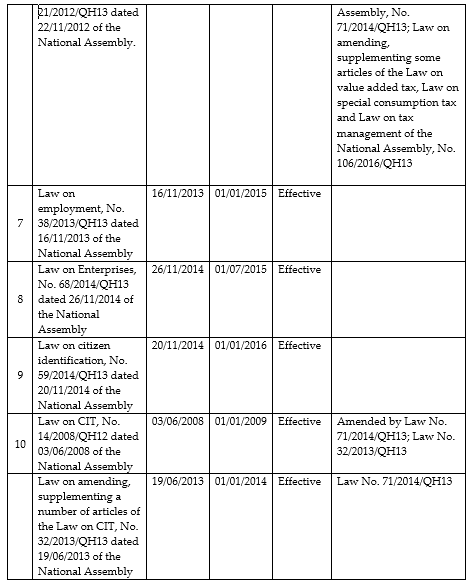

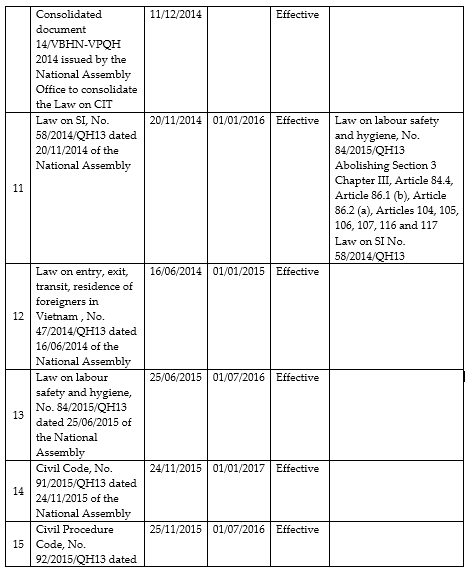

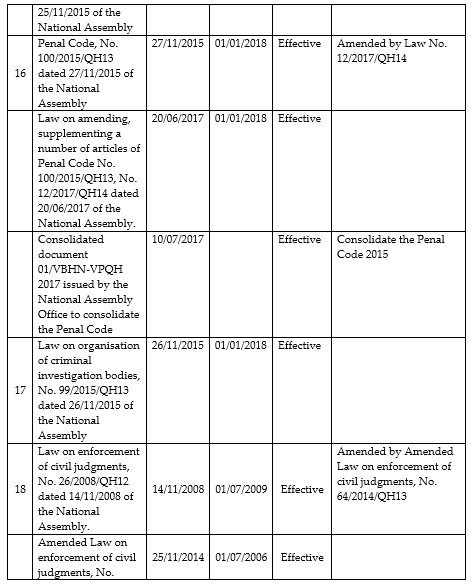

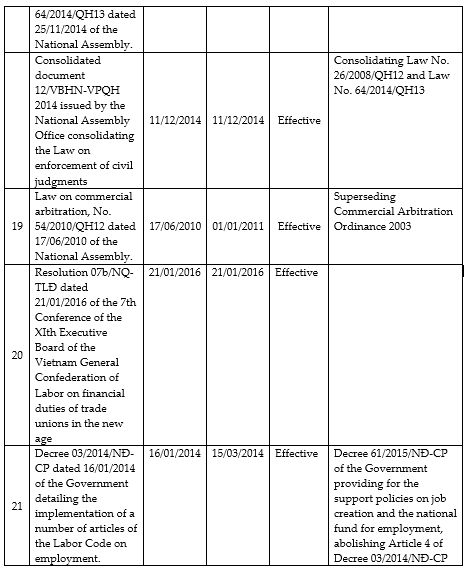

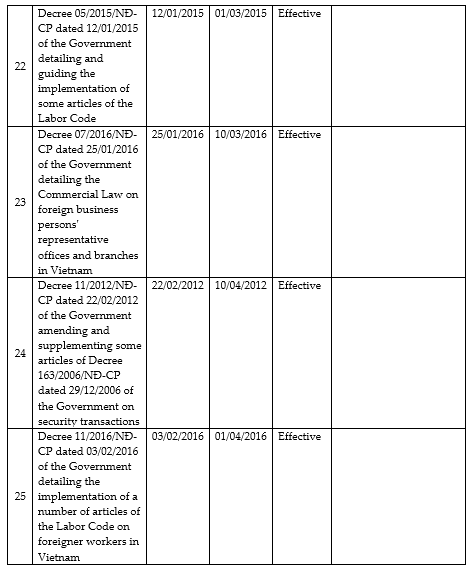

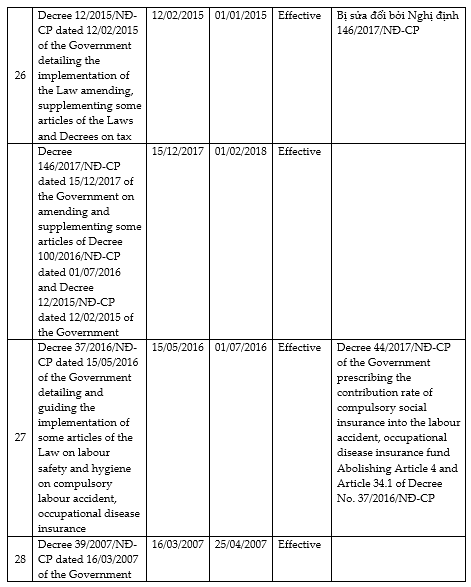

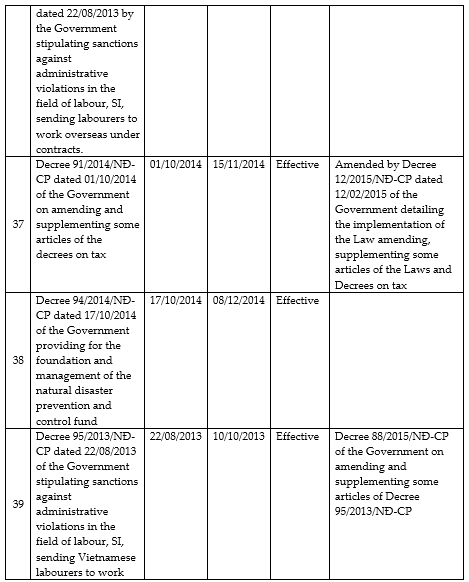

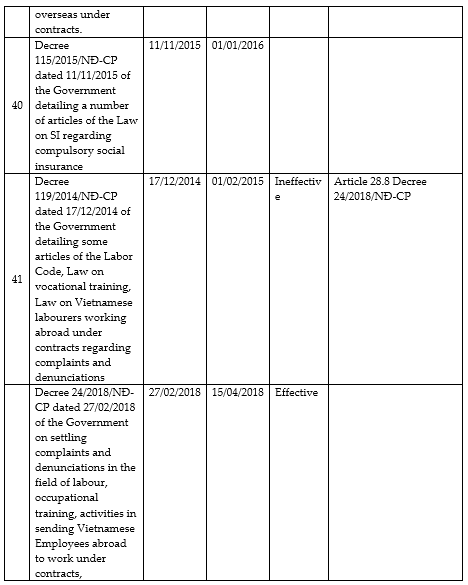

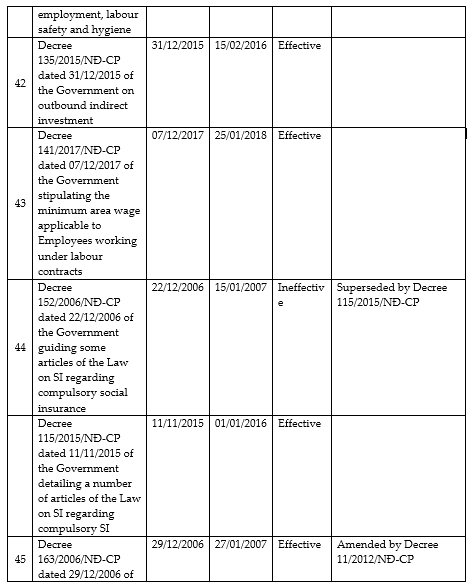

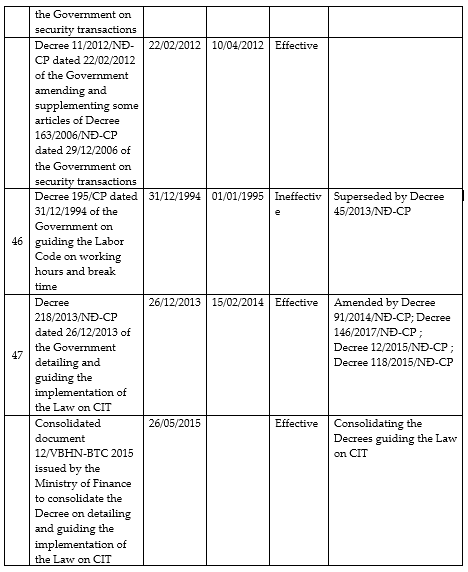

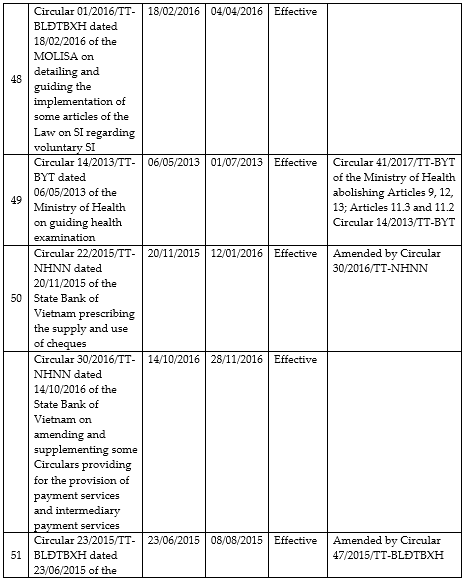

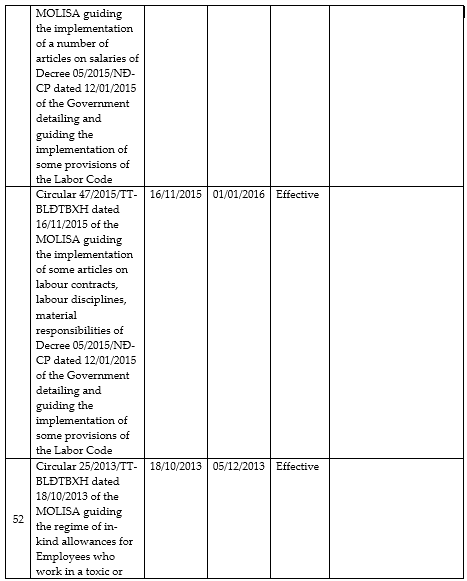

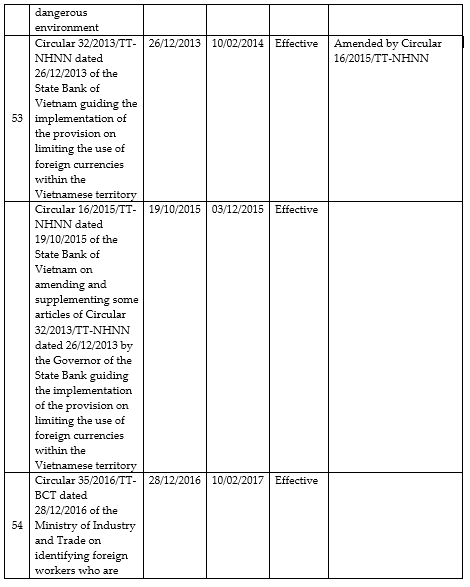

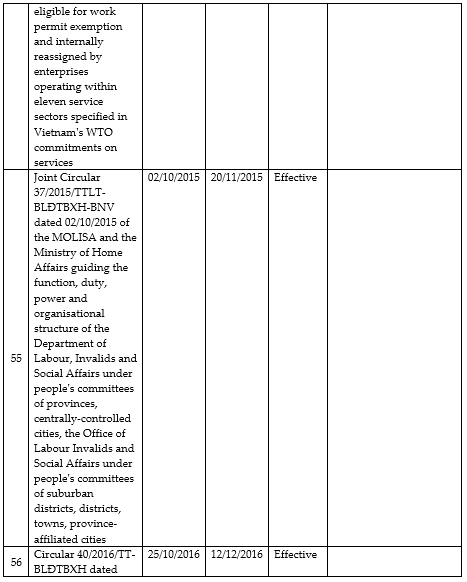

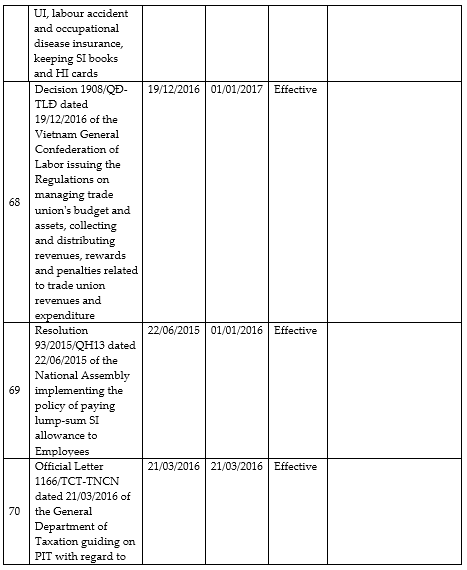

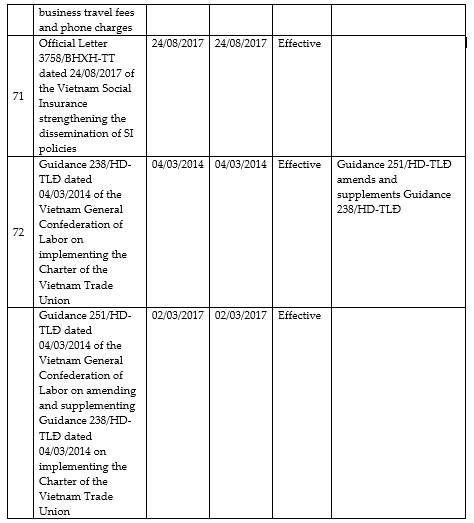

LIST OF LEGAL DOCUMENTS FOR REFERENCE

[1]Articles 10.1 and 10.2 Law on natural disaster prevention and control

[2]Article 15 Decree 94/2014/NĐ-CP dated 17/10/2014

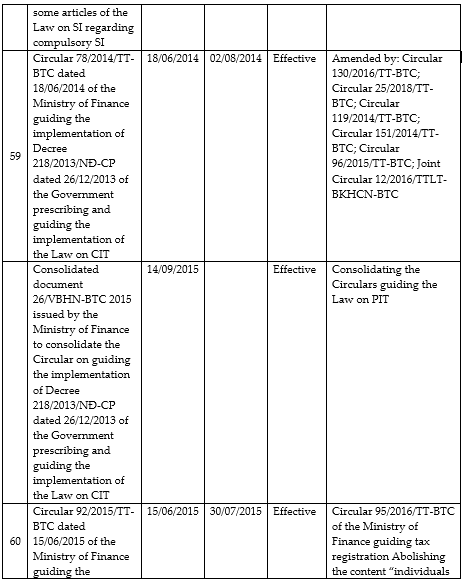

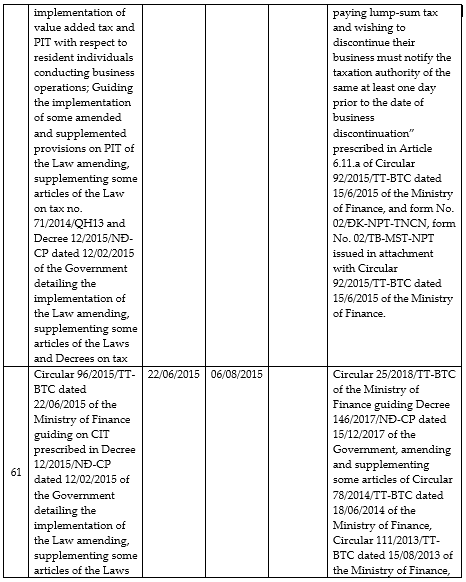

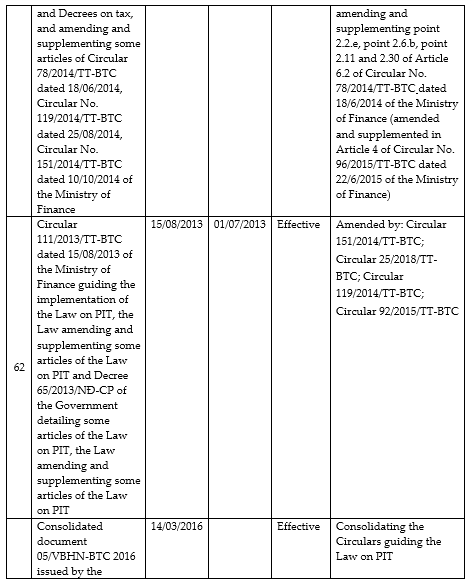

[3]Article 5.1 Decree 94/2014/NĐ-CP dated 17/10/2014

[4]Article 5.2 (b) Decree 94/2014/NĐ-CP dated 17/10/2014

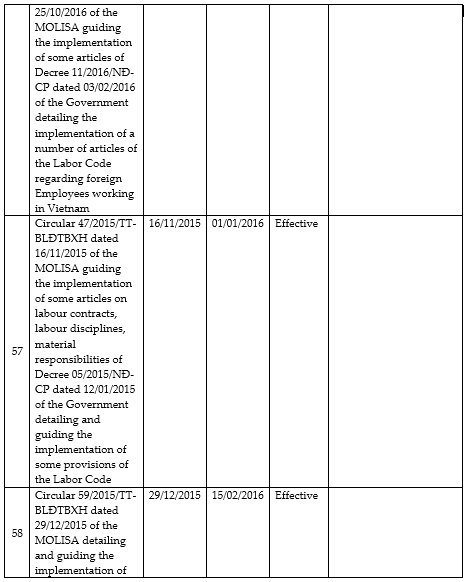

[5]Article 14.4 (a) Circular 47/2015/TT-BLĐTBXH dated 16/11/2015

[6]Article 6 Decree 94/2014/NĐ-CP dated 17/10/2014